Environmental Considerations (ESG)

Our investment approach extends beyond financial success—we are deeply committed to sustainability and responsible investing. By integrating Environmental, Social, and Governance (ESG) principles into our strategies, we aim to create a positive impact on the world while delivering strong financial returns. This dual focus allows us to contribute to a greener, more equitable future.

Our approach – the how

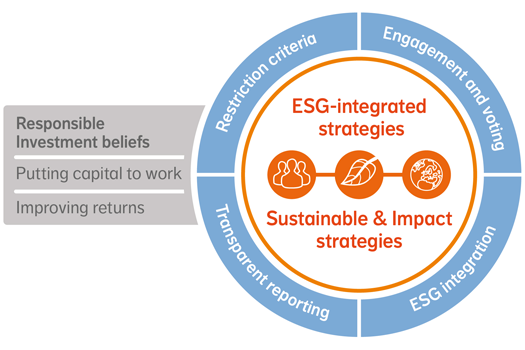

Our approach consists of four building blocks: restriction criteria, engagement and voting, ESG integration and transparent reporting.

Our product offering – the what

Our investment strategies are the tangible result of the beliefs and approach outlined above. We have three types of responsible investing strategy – ESG integrated, Sustainable and Impact – to cater to a variety of client needs across a broad range of asset classes.

Sustainability at the Core

We prioritize investments in sectors and companies that champion sustainable practices. From renewable energy projects to eco-friendly technologies, we ensure our portfolio is aligned with initiatives that reduce environmental footprints and combat climate change.

Our commitment to sustainability doesn’t stop at green investments. We work closely with organizations to encourage responsible governance, diversity, and ethical practices, ensuring that your investments make a real-world difference.

Putting capital to work

Reefcorpfx actively manages assets on behalf of its client base worldwide and participates in global financial markets. We are well aware of the challenges facing the world today, not only in the area of climate change, but also in the social and economic arenas. We have a responsibility to represent the numerous investors who have entrusted their money to us. This extends far beyond the realm of short-term financial gains. We are in a position to make a difference in a far broader context by putting the capital we manage to work.

Driving Social Impact

We believe that responsible investing should improve the communities and societies in which we operate. By supporting businesses that prioritize fair labor practices, community engagement, and social equity, we aim to foster positive societal change alongside financial growth.

Good Governance as a Pillar

Governance is at the heart of ESG investing. We carefully evaluate companies’ governance structures to ensure they prioritize transparency, accountability, and ethical decision-making. Our focus on strong governance helps minimize risk while promoting long-term stability and success.

Partnering for a Better Tomorrow

Through our ESG initiatives, we strive to balance profitability with purpose. By investing in companies and sectors that are making a measurable impact, we enable our clients to be part of the solution to some of the world’s most pressing challenges.